30+ Debt to income ratio for house

To determine your maximum affordable debt-to-income ratio multiply your annual. Adding that measures such as credit score or money in the bank can make a big impact on higher debt-to-income ratios being accepted.

What Should Your Total Debt To Income Ratio Be Quora

To this point the Consumer Financial Protection Bureau defined debt-to-income ratio as the total of monthly debt payments divided by gross monthly income.

. Your debt-to-income DTI ratio and credit history are two important financial health factors lenders consider when determining if they will lend you money. A high debt-to-income ratio can be an indication of financial trouble ahead even if you seem to be easily managing your payments right now. A more prudent DTI ratio is specified in the 2836 rule which dictates that you should not spend more than 28 of your gross income on housing and a maximum of 36 on.

You add up all your monthly debt payments plus insurance then divide it by your total. The debt-to-income ratio will be displayed as a percentage. Automated underwriting system AUS approvals require debt to income.

BACK END DEBT TO INCOME. To calculate your estimated. FRONT END DEBT TO INCOME RATIO REQUIREMENT IS CAPPED AT 469.

Lenders prefer a back-end DTI ratio lower than 36 and no more than 28 for. Divide your monthly debts 1850 by your gross monthly income 5000 and the result is a DTI. Debt-to-income ratio DTI is the ratio of total debt payments divided by gross income before tax expressed as a percentage usually on either a monthly or annual basis.

Your debt-to-income ratio compares all of. The debt-to-income ratio is a tool used by lenders to determine if you can afford the house or not. When you apply for a home equity loan lenders will look at your debt-to-income DTI ratio as one measure of your ability to repay.

Buying a house is expensive. Debt-to-income compares your total monthly debt payments to your total monthly income. You take the entire monthly debt load and divide it by gross monthly income to get the back-end ratio.

For example lets say your debt-to. 469 of the borrowers 300000 gross monthly income is 140700. As a quick example if.

You want your total monthly debts to account for no more than 36 percent of your monthly income.

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

15 Debt Payoff Planner Apps Tools Get Out Of Debt Debt To Income Ratio Managing Finances Money Saving Strategies

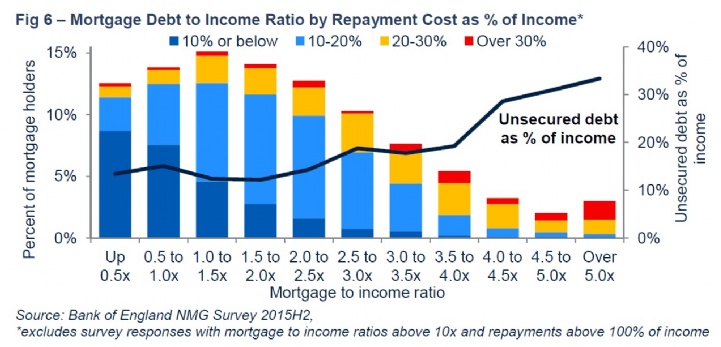

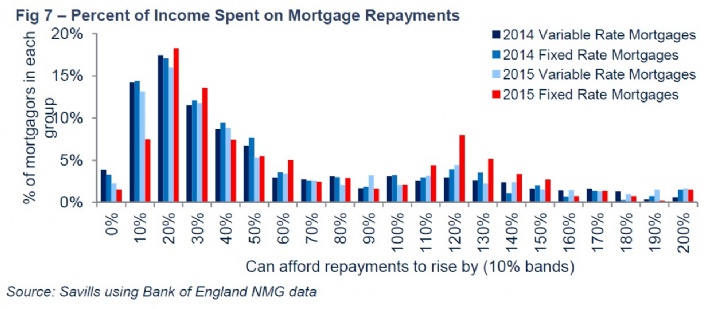

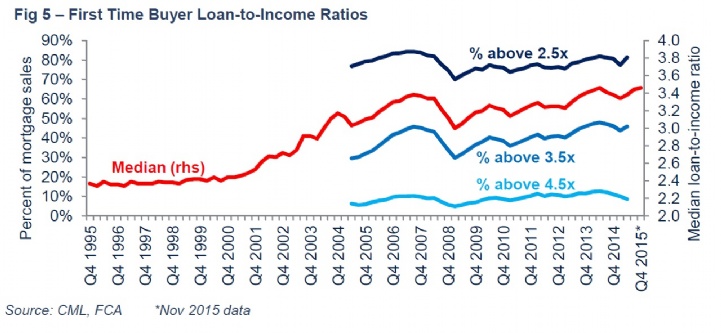

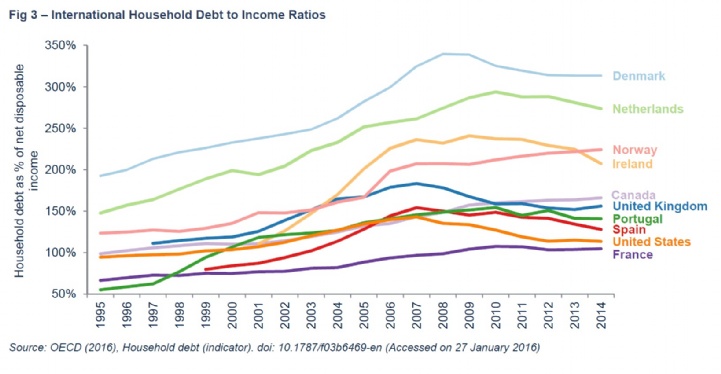

Savills Household Debt

Savills Household Debt

Just Because You Hear Something Does Not Mean It S True There Are Myths And Then There Are Facts Mortgag Home Buying Debt To Income Ratio Mortgage Rates

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Fha Debt To Income Calculator Debt To Income Ratio Real Estate Advice Fha Loans

Savills Household Debt

Savills Household Debt

Stanford Cs 007 08 2019 Personal Finance For Engineers Financial

What Should Your Total Debt To Income Ratio Be Quora

.jpg)

Savills Household Debt

If Someone Took The Us Debt To Income Ratio And Made A Percentage Comparison To A Household Budget Of 80 000 What Would The Numbers Be Quora

Your Debt To Income Ratio Is All Your Monthly Debt Payments Divided By Your Gross Monthly Income This Number Is Debt To Income Ratio Home Buying Process Debt

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora

Debt To Income Ratio Can You Really Afford That Car Or Home Money Life Wax Debt To Income Ratio Student Loans Student Loan Help

What Is The Maximum Housing Ratio For A Conventional Mortgage What Is The Max Total Debt To Income Ratio Quora